NRI delivered a tailored Continuing Professional Development (CPD) course for four senior staff from Government ministries and agencies in Rwanda from 15-26 September. The 10-day programme was designed and delivered by Dr Gideon Onumah, Principal Agricultural Marketing and Finance Economist at NRI.

The training was closely aligned with Rwanda’s Vision 2050 Framework and the country’s National Strategy for Transformation, both of which aim to boost agricultural productivity and output while strengthening resilience to climate change.

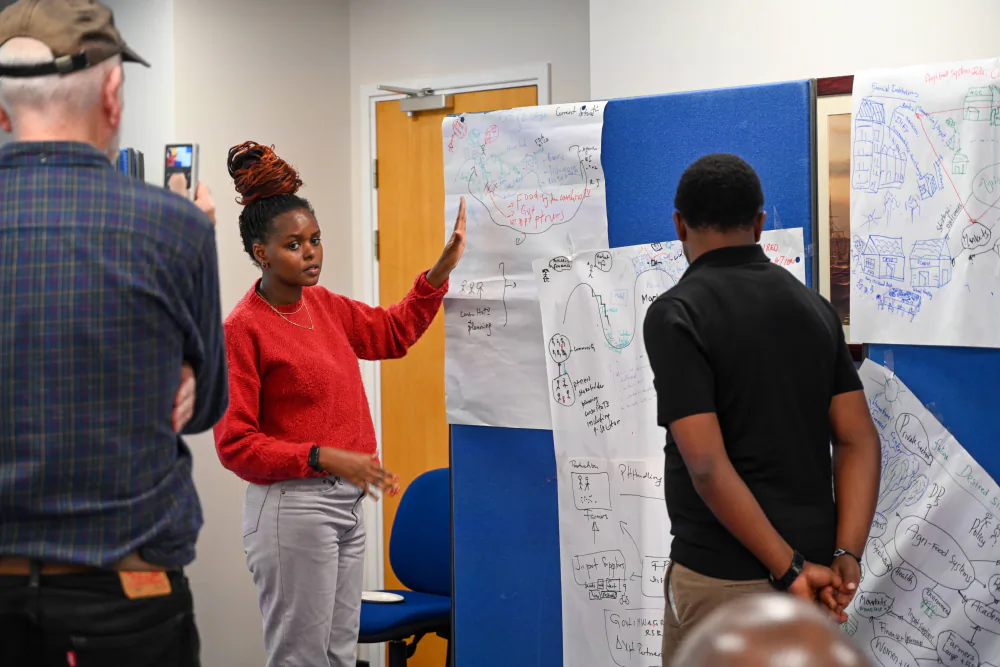

The programme took a systems perspective on access to finance for actors in agrifood systems in developing countries such as Rwanda. It acknowledged that smallholder farmers, and most small- and medium-scale enterprises (SMEs) involved in aggregation, processing, and food trade often face severe liquidity and financing constraints. The approach adopted further stressed that filling existing financing gaps does not simply require replicating models implemented elsewhere, but rather understanding the underlying, context-specific causes of the under-supply of finance. The training thus sought to equip participants with knowledge and robust tools to assess credit risks in agrifood systems and the de-risking mechanisms that enhance the supply of finance.

Effective risk management for sustainable, inclusive financing

Participants explored the strengths and weaknesses of different insurance models in the module on agricultural insurance. These included traditional indemnity-based crop insurance schemes to index-based products that use weather data, remote sensing and satellite imagery. Discussions of case studies from Kenya, Ethiopia, and Rwanda highlighted that fostering uptake of insurance by actors in agrifood systems requires bundling it with production credit and effective contracting arrangements in output marketing that reduce default rates. Through practical exercises, participants were encouraged to design and price insurance products for specific crops and regions in Rwanda and develop distribution mechanisms to effectively reach rural farming communities.

One of the participants said: ‘The training offered valuable insights into agricultural finance, insurance and climate risk management in Rwanda. It included case studies and interactive exercises. Many thanks to the organisers and facilitators for a well-structured and impactful program. We also encourage a second round and stronger collaboration between Rwanda Agriculture Board, MINAGRI and NRI to foster ongoing capacity building within Rwanda.’

Another module explored finance in agrifood systems in Rwanda, considering the unique agroclimatic and socio-economic landscape. Participants were encouraged to review the policy, regulatory and institutional environment for financial intermediation, noting that mechanisms aiming to assure sustainability of and confidence in financial intermediaries often limit access unless specific de-risking actions are implemented. This framework was applied in terms of access to traditional financial products such as loans, overdrafts, trade credits and equipment leasing. Innovative approaches explored include value chain financing, inventory finance, venture capital, blended finance and impact investment. The evolving role of mobile payment systems in fostering financial inclusion was also discussed.

Applications in policy and practice

Given the complex and often mutually reinforcing challenges facing agrifood systems, the programme focused on key areas requiring policy intervention. One example is the growing impact of climate change on Rwanda’s agriculture and food systems, which underscores the need for innovative production approaches. This prompted the inclusion of discussions on agroecology and conservation agriculture.

Other key topics included strategies to reduce postharvest losses, the importance of food quality assurance systems, food innovation, and the need to mainstream gender in policies and programmes to enhance access to finance

Finally, participants examined policy frameworks and processes aimed at improving the supply of finance to key actors in agrifood systems. The sessions highlighted how agrifood policies in Africa have evolved over recent decades and underscored the importance of institutionalising broad stakeholder participation, not only in policy formulation but also in monitoring the implementation of reforms in agrifood policy and regulatory frameworks.

Dr Onumah noted: ‘The programme was designed to shift the focus of efforts to improve access to finance in agrifood systems from simply identifying and replicating innovative models to building participants’ understanding of the often mutually reinforcing factors that constrain supply. Sustainable and inclusive financial innovations must reflect contextual challenges, particularly those that heighten risk aversion among financial intermediaries. Broad-based stakeholder engagement also emerged as a critical factor in fostering meaningful financial innovation. These objectives were achieved through the programme, and NRI looks forward to continued collaboration with Rwanda and other countries in this area.’

Participants received professional certification recognising their enhanced capacity to design and implement financial and risk management solutions for Rwanda’s agriculture. Beyond individual learning, the course contributes to NRI’s growing portfolio of CPD opportunities, drawing on the institute’s expertise to support professionals, strengthen partnerships and extend NRI’s impact worldwide.